মাস্টার অফ অ্যাপ্লাইড ফাইন্যান্স অ্যান্ড ক্যাপিটাল মার্কেট

Master of Applied Finance and Capital Market (MAFCM)

MAFCM 8th Batch (Spring 2025)

Application Deadline: 06 January 2025, Admission Test: 10 January 2025

Nonetheless, in Bangladesh, the need for skilled professionals in the financial market in general and the capital market, in particular, has been on the rise. The MAFCM program of BICM, with its world-class curriculum, will sharpen a student’s required theoretical, quantitative, and technical skills by providing a blend of rigorous academic and practical application. Hence, the program is expected to bridge the long-felt gap between the skills required and those existing in this dynamic field of financial markets, especially the capital market.

New innovations in the applications of finance are making it crucial for stakeholders in the industry to keep pace with these developments. BICM is aiming to create the best-equipped financial managers in the country with this uniquely designed program. Those aspiring to excel in a career in finance, banking, merchant banking, asset and funds management, financial analysis, and financial regulation will experience assimilation of essential knowledge and skills in an increasingly challenging financial environment.

The objective of the MAFCM Program

BICM is offering the ‘Master of Applied Finance and Capital Market’ (MAFCM) to strengthen the Bangladesh capital market through elevating the knowledge of stakeholders. The capital market is dynamic and is evolving over time both locally and globally. One must be competent enough to excel in the field of capital market with the required set of management, mathematical and technical skills. The MAFCM program is designed to inculcate these skills in students so that they can cater to the needs of competent financial managers.

Duration and Credit Hours

The duration of the program is 2 years (4 semesters, each of 6 months). The program is of 51 credit hours.

Minimum Credit Requirements

The minimum credit requirement for obtaining the MAFCM degree is 51 (fifty-one). Of the total required credits, 48 credits are to be completed as course work and 3 credits are to be earned from project work.

Program Completion Period

The program can be completed in 2 years (4 semesters). However, a student may complete the program in a maximum duration of 6 (Six) years from the date of admission into the program, after which, admission of the student will be deemed to have expired.

Semesters

There shall be two semesters in a calendar year. The Spring semester (January – June) and Summer semester (July – December). The Academic Year is the same as the calendar year.

Student Intake per Semester

A maximum of 30 students per semester is admitted to the MAFCM program.

Number of Intake per year

There are two intakes per year, one in December for Spring Semester (January-June) and the other in June for Summer Semester (July-December)

Admission/Eligibility Criteria

The minimum academic requirement for admission into the program is a 4-year Bachelor’s degree (or equivalent) from a recognized institution having minimum 2nd class/division, or Master’s degree in case of Bachelor’s degree (or equivalent) with a duration of less than 4 years from a recognized institution, having minimum 2nd class/division at Master level. Preference will be given to those having experience in the fields of finance, capital market operations, capital market regulations, capital market policy formulation, capital market research, accounting, auditing, banking etc. Registered/Enrolled students of any accounting and finance professional institute (such as CFA, ICAB, ICMAB, ACCA, CIMA, CPA,ICSB etc.) will also get preference.

For foreign degrees, equivalence certificate from the University Grants Commission of Bangladesh has to be provided. All applicants must appear in a written test, followed by a viva-voce for those who pass the written test. The final score for selection will be prepared considering the performance in the written test, viva-voce, previous academic records, and relevant experience. Selections will be made based on the combined score.

Members of any accounting and finance profession like CFA, ICAB, ICMAB, ACCA, CMA, CPA, ICSB, etc. and those having GMAT score of at least 500 or GRE score of at least 300 will be eligible for direct admission (Subject to satisfactory appearance in the viva-voce).

Course Structure

The MAFCM program comprises of 16 courses, each of three credits. The course distribution is as follows:

| Foundation courses | 4 Courses | 12 Credits |

| Core courses | 8 Courses | 24 Credits |

| Elective courses | 4 Courses | 12 Credits |

| Project paper | 3 Credits | |

| Total | 51 Credits |

Course Distribution

- MAFCM 501: Introduction to Statistics

- MAFCM 502: Economics for Investment Decisions

- MAFCM 503: Financial Statement Analysis

- MAFCM 504: Financial Markets and Institutions

Core courses:

- MAFCM 601: Corporate Finance

- MAFCM 602: Equity Valuation

- MAFCM 603: Investment Banking and Capital Market Operations

- MAFCM 604: Corporate Governance and Ethics

- MAFCM 605: Fixed Income Securities

- MAFCM 606: Capital Market Regulations

- MAFCM 607: Compliance and Supervision in Capital Market

- MAFCM 608: Portfolio Management and Investment Planning

Elective courses: Students are to take a total of five courses from the following list, including the mandatory Project Paper; the other four can be from Quantitative Finance, Financial Markets or a combination thereof:

Quantitative Finance

- MAFCM 651: Risk Management in Capital Market

- MAFCM 652: Financial Modeling

- MAFCM 653: Data Analytics for Finance

- MAFCM 654: Empirical Methods in Finance

- MAFCM 655: Fintech

Financial Markets

- MAFCM 675: Financial Derivatives

- MAFCM 676: Alternative Investments

- MAFCM 677: Mergers and Acquisitions

- MAFCM 678: Trading and Technical Analysis

- MAFCM 679: Behavioral Finance

- MAFCM 680: Islamic Finance and Capital Market

- MAFCM 681: Sustainable Finance

- MAFCM 682: Innovations in Financial Markets

- MAFCM 683: Contemporary Issues in Finance

- MAFCM 684: Accounting for Financial Instruments

Project Paper

- MAFCM 698: Project paper

Teaching Methods

Face-to-face learning method will be used for delivering lectures and conducting examinations. However, under extraordinary circumstances, alternative teaching strategies like blended learning and/or flipped learning methodologies may be used temporarily. In addition, teachers will occasionally use cooperative learning strategies for developing teamwork, collaboration, communication, and social skills of the learners. Teaching methods will include class lectures, case analyses, group discussions and so on. Guest teachers from the industry, regulatory bodies, and different professional bodies will be invited to share real-life experiences in the relevant courses. There will be industry visits and exposure visits to different stakeholders of the capital market for the students to experience hands-on operations of different aspects of capital markets. Such visits will include but not be limited to visits to the local stock exchanges, brokerage houses, BSEC, CDBL, Credit Rating Companies, leading listed companies and their registered offices, etc. Medium of instruction shall be English.

Assessment Procedure

Students will be assessed on a continuous basis throughout the semester. There will be two mid-terms and one final examination in a semester. The mid-term examinations will be 15 marks each. The duration of these examinations will depend on the course teacher but should not be less than one hour. The final examination will be of 40 marks and the duration will be three hours. Class attendance and participation will carry 5 marks. The term paper(s)/case report(s) and presentations will carry 15 and 10 marks respectively.

| Assessment Criteria | Marks | Weight |

| Class Attendance and Participation | 5 | 5% |

| Mid Term – 1 | 15 | 15% |

| Mid Term – 2 | 15 | 15% |

| Term Paper / Case Report | 15 | 15% |

| Presentation | 10 | 10% |

| Semester Final | 40 | 40% |

| Total | 100 | 100% |

The combined score obtained in (i) Class Attendance and Participation (ii) Mid-Term – 1 (iii) Mid-Term – 2 (iv) Term Paper/Case Report (v) Presentation and (vi) Semester Final will be converted to letter grades and will be reflected in the students grade sheet and transcript.

Grading Policy

The UGC prescribed grading policy will be followed. The grading will be done on a 4.00 scale with the highest grade being A+ (A Plus) and the lowest grade being F. The mark range, corresponding letter grades and grade points will be as follows:

Degree Requirements

A student will be considered eligible to be awarded the degree of MAFCM only upon fulfilling the following requirements:

a. Completion of 51 credits (48 credits from course work and 3 credits from the project paper/dissertation)

b. Having earned a minimum Cumulative Grade Point Average (CGPA) of 2.50 on a scale of 4.00.

Fees and Charges(after 50% waiver on course fee announced in October 2022)

| Sl. | Item Details | Amount (Taka) |

| 1 | Application Form | 1,000/- |

| 2 | Admission Fee | 10,000/- |

| 3 | Semester Fee (Per Semester) | 6,000/- |

| 4 | Course fee per regular course (3 credits) | 6,000/- |

| 5 | Project Paper fee | 12,000/- |

| 6 | Computer Lab Fee (One time during admission) | 4,000/- |

Fees and charges are subject to change and subject to revision from time to time subject to the prior approval of the Dhaka University/appropriate authority

Students have to bear all other fees payable to the University of Dhaka apart from the course and semester fee. These include registration and migration fee, examination fee, marks sheet fee, convocation fee etc. The rates, as decided by the University of Dhaka, for these fees, will have to be paid by the students.

Minimum number of course per semester

A student has to take at least two courses (6 credits) in a semester unless the student has only one course left for the completion of the degree in the last semester. A student taking a minimum course load will not be allowed to drop or withdraw from any course in a semester unless that course is replaced with another course.

Course Drop

A student may drop a course within 2 (two) weeks from the start of a semester, whereby no financial penalty will be levied and there will not be any record of the student in the concerned course in that semester nor in the student’s academic records. However, if a student wishes to drop after 2 (two) weeks of classes, s/he will get a 50% refund of the course fees. However, a student will not be allowed to drop a course after the 2nd week of the semester calendar.

Course Withdrawal

A student may withdraw from a course at any point in the semester after the 4th week of classes, giving acceptable reasons. However, in the case of such course withdrawal(s), no refund of course fees will be made and the letter grade ‘W’ will be recorded in the student’s grade-sheet.

Course Retake

A student earning a grade B (Plain) or below in a course may apply for retaking a course in the next available semester that course is offered.

A student having an ‘F’ grade in any course must retake that course and earn a passing grade.

Semester Drop

A student may, with the permission of the program coordinator, drop a semester if the reasons are convincing to the BICM authority. However, the degree requirements are to be completed within 6 (six) years from the date of admission into the program.

Adoption of Unfair Means

Students adopting unfair means in the examinations will be subject to disciplinary action as per BICM rule and may be expelled, depending on the gravity of the situation and/or the incident(s).

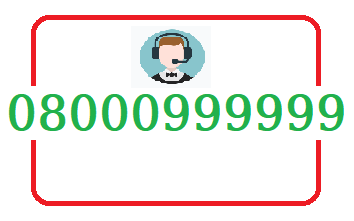

Application procedure:

(Choose the Master’s / PGDCM tab, fill up the required information, proceed to payment and pay Tk. 1,000/– using your preferred online wallet or card)

To apply offline, please contact Registrar’s Office

Bangladesh Institute of Capital Market (BICM)

34, Topkhana Road (Ground Floor), Dhaka – 1000

Phone (PABX): +880-2-41053244, +880-2-41053245, +880-2-41053246, +880-2-41053247, Ext: 401

Phone (Direct): +880-2-41053238

Mobile and WhatsApp: +88-01572112496

E-mail: info@bicm.ac.bd, imran@bicm.ac.bd