বিআইসিএম এর প্রথম রিসার্চ সেমিনার অনুষ্ঠিত হবে ২৮ জানুরারি ২০২০

BICM Research Seminar 1

We cordially invite you to join our research seminar and contribute to shared academic excellence. Please note the following specifics about the January seminar.

|

Paper details |

|

|

Title |

The effects of IPO financing and monetary policy on economic growth in Bangladesh: A dynamic assessment |

|

Authors |

Dr. Mahmuda Akter Executive President, BICM and Professor, Department of Accounting and Information Systems, University of Dhaka |

|

|

Dr. Suborna Barua Research Fellow (Part-time), BICM and Associate Professor, Department of International Business, University of Dhaka |

|

Presentation details |

|

|

Presenter |

Professor Dr. Mahmuda Akter |

|

Date: |

January 28, 2021 (Thursday) |

|

Time: |

2:30 - 4:00 PM |

|

Venue: |

Multi-purpose Hall Room (8th Floor), BICM |

|

Expected Participants |

Faculty Members of BICM & guests |

|

Discussant |

Eminent scholar and policy expert Professor Mohammed Farashuddin, PhD Chief Advisor, East West University Former Governor, Bangladesh Bank and Founding Vice Chancellor, East West University |

|

About the presenter |

|

Professor Dr. Mahmuda Akter has been teaching in the Department of Accounting & Information Systems at the University of Dhaka for about 28 years. She has completed her PhD (major in Management Science and Engineering) as well as Master’s (major in Management Science and Engineering) from the University of Tsukuba, Japan. She also has completed Master’s of Commerce in Accounting with Honors from the University of Dhaka. Dr. Akter passed certification courses on International Financial Reporting Standards (IFRS) as well as on International Standards on Auditing (ISA) from the Institute of Chartered Accountants in England and Wales [ICAEW]. Her area of specialization is Management Accounting. She also delivers lectures in Security Analysis and Portfolio Management, Econometrics, Statistics, Accounting Information Systems, Financial Management, Research Methodology, Advanced Financial Accounting, Strategic Management Accounting etc. She has several publications in internationally and nationally reputed refereed journals. She has written different chapters in several edited books published abroad. On lien from her teaching role since August 03, 2020, Dr. Akter is serving as the Executive President of Bangladesh Institute of Capital Market, an entity of Ministry of Finance focused for education and research. |

Join us LIVE at BICM Facebook page https://www.facebook.com/bicm.ac.bd

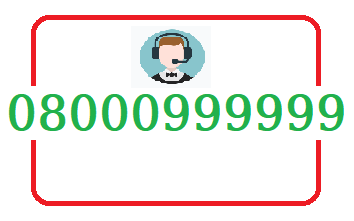

The paper abstract is on the following page. If you have any questions regarding the seminar or you wish to present a paper or invite a guest researcher, please do not hesitate to communicate S. M. Kalbin Salema at kalbin@bicm.ac.bd.

The effects of IPO financing and monetary policy on economic growth in Bangladesh: A dynamic assessment

Dr. Mahmuda Akter[1]

Dr. Suborna Barua[2]

Abstract

Bangladesh is considered a fast-growing emerging economy and the new Asian tiger. The increasing need for capital funds in Bangladesh is largely met by banks, mainly due to the country’s underdeveloped nature of the stock market. Bank financing is assumed to be influenced by monetary policies, particularly, by bank rates adopted each year by the central bank of Bangladesh. Yet, the effectiveness of monetary policy in encouraging the Bangladesh’s economic growth remains unclear. On the other hand, while some studies stress the need for strengthening the debt and equity securities markets to fuel Bangladesh’s fast economic growth, capital financing through primary market remains insignificant compared to that arising from the banking sector. This raises debate about whether or to what extent the stock market contributes to economic growth in the country.

To address the understanding gap, in this paper, we examine the impact of capital financing through equity initial public offerings (IPO) and bank rate on economic growth of Bangladesh. We use annual data from 1981 to 2019 and employ an autoregressive distributive lag (ARDL) framework to examine the long-run and short-run impacts of IPO financing and bank rate on GDP growth rate.

Our findings suggest the existence of a long-run cointegrating relationship between IPO financing, bank rate, and GDP growth. We find that IPO financing does not have a significant long-run impact but shows only a two-period short-run positive impact on economic growth. On the other hand, bank rate shows a long-run negative and a one-period short-run positive impact on economic growth. Findings overall suggest that IPO financing yet does not significantly contribute to economic growth in the long-run while giving only a temporary boost. Further, increases in bank rate - as one would expect - depress economic growth in the long-run. However, an announcement of bank increase could encourage herding behavior of borrowing from banks immediately after the announcement to avoid an increased cost of financing in the future. Our findings stress the need for encouraging more quality IPO issuances in order to make it a key driver of faster economic growth that Bangladesh aims to achieve in the next few decades.

[1] Executive President, Bangladesh Institute of Capital Market; Professor (On lien), Department of Accounting & Information Systems, University of Dhaka; email: ep@bicm.ac.bd

[2] Research Fellow (Part-time), Bangladesh Institute of Capital Market; Associate Professor, Department of International Business, University of Dhaka; email: sbarua@du.ac.bd